SCROLL

SCROLL

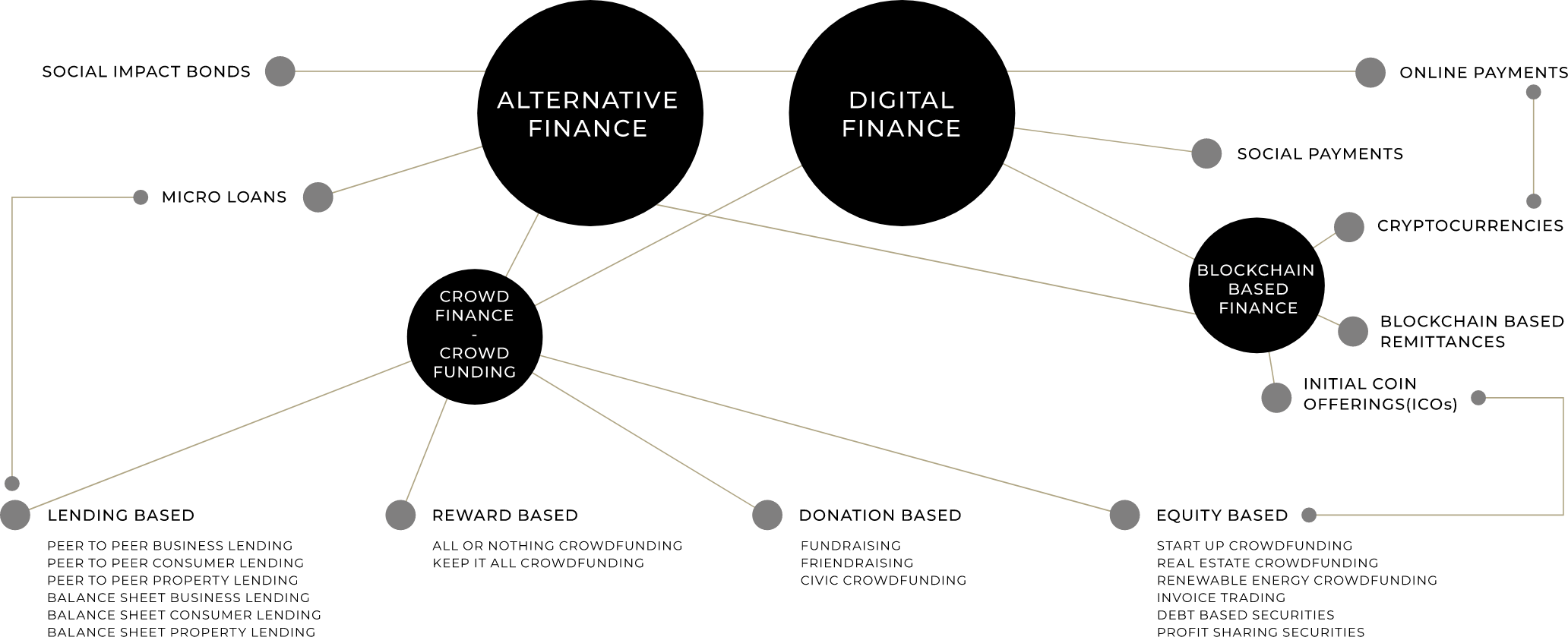

BELEGA is a FinTech start-up planning to deliver technology that facilitates SME fund raising by addressing the global cross-border Crowdfunding opportunity, nurturing relationships with the startupcommunity, and supporting the acceleration of our client’s business growth across jurisdictions in order to become a leading global SME crowdfunding platform.

BELEGA believes in the long-term alignment of global regulators to the benefits of Tokenisation and Blockchain/DLT technology which delivers superior consumer protection and efficiencies, and that this alignment will lead to the growth and value creation of global trading platforms.